Specialist Insights: What You Need to Learn About Credit Repair Solutions

Specialist Insights: What You Need to Learn About Credit Repair Solutions

Blog Article

A Comprehensive Overview to Exactly How Debt Repair Service Can Transform Your Credit History

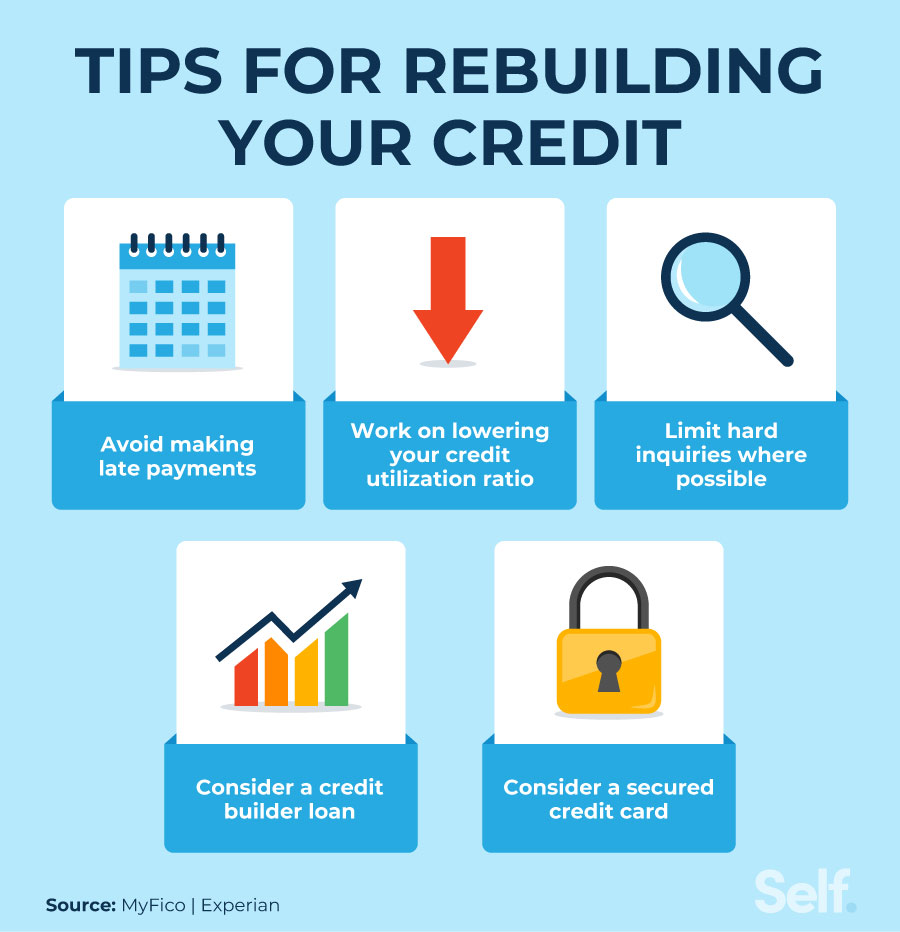

Understanding the details of credit fixing is essential for anybody looking for to boost their economic standing. By addressing issues such as settlement background and credit usage, people can take aggressive steps towards improving their credit report ratings.

Recognizing Credit Report Scores

Recognizing credit history is crucial for any individual looking for to enhance their economic health and wellness and accessibility far better loaning alternatives. A debt rating is a mathematical representation of an individual's creditworthiness, commonly ranging from 300 to 850. This rating is produced based on the details contained in an individual's credit rating report, which includes their credit rating, arrearages, settlement background, and kinds of credit score accounts.

Lenders utilize credit history to assess the danger related to offering money or prolonging credit. Higher scores show reduced risk, typically bring about much more positive loan terms, such as lower passion prices and greater credit rating restrictions. On the other hand, reduced credit report can lead to greater rates of interest or rejection of credit score altogether.

A number of aspects affect credit rating, including payment history, which represents roughly 35% of the score, complied with by credit use (30%), length of credit rating (15%), kinds of debt in operation (10%), and new credit scores inquiries (10%) Recognizing these elements can encourage individuals to take actionable steps to improve their ratings, ultimately enhancing their financial chances and security. Credit Repair.

Usual Credit Score Issues

Many people encounter typical debt problems that can impede their monetary progression and influence their credit rating. One common issue is late repayments, which can considerably harm credit ratings. Even a solitary late settlement can continue to be on a credit scores record for several years, impacting future loaning capacity.

Identification theft is one more significant worry, possibly leading to deceitful accounts showing up on one's credit scores report. Such scenarios can be testing to correct and may need considerable effort to clear one's name. In addition, inaccuracies in debt reports, whether as a result of clerical errors or outdated information, can misrepresent an individual's creditworthiness. Attending to these usual credit scores issues is necessary to boosting financial health and developing a solid credit score profile.

The Credit Repair Work Refine

Although credit score repair service can appear overwhelming, it is an organized process that individuals can carry out to improve their credit rating and remedy errors on their credit scores records. The initial step involves getting a duplicate of your credit rating record from the three significant credit rating bureaus: Experian, TransUnion, and Equifax. Review these records meticulously for errors or disparities, such as inaccurate account information or out-of-date information.

When errors are determined, the next step is to challenge these errors. This can be done by contacting the credit rating bureaus directly, offering documents that sustains your case. The bureaus are called for to investigate conflicts within thirty days.

Maintaining a consistent repayment history and taking care of credit score usage is additionally vital during this procedure. Finally, checking your credit report consistently makes sure recurring accuracy and assists track improvements in time, reinforcing the efficiency of your debt fixing efforts.

Advantages of Credit Repair

The benefits of credit rating repair work extend much beyond merely increasing one's debt rating; they can considerably impact economic security and chances. By dealing with inaccuracies and unfavorable items on a credit record, people can enhance their Learn More credit reliability, making them extra attractive to lending institutions and banks. This improvement commonly leads to far better rate of interest on loans, lower costs for insurance coverage, and raised possibilities of authorization for credit scores cards and home mortgages.

In addition, credit score fixing can promote access to vital services that call for a credit rating check, such as leasing a home or obtaining an utility solution. With a much healthier credit report profile, people may experience enhanced self-confidence in their economic choices, allowing them to make bigger acquisitions or financial investments that were previously out of reach.

Along with concrete monetary benefits, credit rating repair work promotes a feeling of empowerment. People take control of their monetary future by actively handling their credit, bring about more educated selections and higher financial literacy. In general, the benefits of credit score repair service add to a much more stable economic landscape, eventually promoting lasting financial growth and individual success.

Choosing a Credit Report Fixing Solution

Picking a credit score repair service calls for careful consideration to ensure that individuals obtain the assistance they need to boost their monetary standing. Begin by looking into possible firms, concentrating on those with favorable client testimonials and a tested performance history of success. Transparency is essential; a trustworthy solution ought to plainly detail their processes, charges, and timelines ahead of time.

Following, validate that the credit report fixing service abide by the Credit report Repair Service Organizations Act (CROA) This government regulation secures consumers from misleading techniques and sets standards for credit repair services. Avoid business that make unrealistic guarantees, such as ensuring a certain rating rise or asserting they can remove visit the site all adverse items from your record.

In addition, consider the level of consumer support supplied. A good credit rating fixing service need to offer individualized aid, allowing you to ask inquiries and obtain prompt updates on your progress. Try to find services that offer a thorough analysis of your credit history record and develop a customized approach tailored to your certain situation.

Ultimately, selecting the right credit scores repair service can lead to significant renovations in your credit report rating, encouraging you to take control of your financial future.

Final Thought

To conclude, efficient credit repair service approaches can significantly boost credit ratings by addressing typical issues such as late click this repayments and errors. A detailed understanding of credit report factors, incorporated with the interaction of reliable credit history repair services, helps with the settlement of adverse products and continuous progress tracking. Ultimately, the successful renovation of credit history not only results in much better financing terms however likewise cultivates greater economic chances and security, highlighting the relevance of aggressive credit rating monitoring.

By attending to problems such as settlement history and credit utilization, people can take proactive steps toward improving their credit ratings.Lenders make use of credit ratings to assess the danger associated with providing cash or expanding credit rating.An additional frequent problem is high credit report utilization, specified as the ratio of existing credit scores card equilibriums to total available debt.Although credit history repair service can appear daunting, it is a systematic procedure that people can carry out to boost their credit rating ratings and correct errors on their credit rating reports.Following, validate that the debt fixing solution complies with the Credit report Repair Work Organizations Act (CROA)

Report this page